SBA Disaster Assistance – Tornado Damage January 2023

Low-interest disaster loans from the U.S. Small Business Administration (SBA) are available to businesses and residents in Alabama following the announcement of a Presidential disaster declaration due to damages from severe storms, straight-line winds and tornadoes on Jan. 12. Applicants may apply online using the Electronic Loan Application (ELA) via SBA’s secure website at https://disasterloanassistance.sba.gov/ela/s/ and should apply under SBA declaration # 17759.

Low-interest disaster loans from the U.S. Small Business Administration (SBA) are available to businesses and residents in Alabama following the announcement of a Presidential disaster declaration due to damages from severe storms, straight-line winds and tornadoes on Jan. 12. Applicants may apply online using the Electronic Loan Application (ELA) via SBA’s secure website at https://disasterloanassistance.sba.gov/ela/s/ and should apply under SBA declaration # 17759.

Deadlines: 3/16/23 for Physical Damage, 10/16/23 for Economic Injury.

As of March 10, SBA had approved a total of $6,374,500 in disaster loans.

The disaster declaration now covers Autauga, Coosa, Dallas, Elmore, Greene, Hale, Mobile, Morgan, Sumter and Tallapoosa counties in Alabama, which are eligible for both Physical and Economic Injury Disaster Loans from the SBA. Small businesses and most private nonprofit organizations in the following adjacent counties are eligible to apply only for SBA Economic Injury Disaster Loans (EIDLs): Baldwin, Bibb, Chambers, Chilton, Choctaw, Clay, Cullman, Lawrence, Lee, Limestone, Lowndes, Macon, Madison, Marengo, Marshall, Montgomery, Perry, Pickens, Randolph, Shelby, Talladega, Tuscaloosa, Washington and Wilcox in Alabama.

- Businesses and private nonprofit organizations of any size may borrow up to $2 million to repair or replace disaster-damaged or destroyed real estate, machinery and equipment, inventory, and other business assets.

- For small businesses, small agricultural cooperatives, small businesses engaged in aquaculture and most private nonprofit organizations, the SBA offers Economic Injury Disaster Loans (EIDLs) to help meet working capital needs caused by the disaster. Economic Injury Disaster Loan assistance is available regardless of whether the business suffered any physical property damage.

- Disaster loans up to $200,000 are available to homeowners to repair or replace disaster-damaged or destroyed real estate. Homeowners and renters are eligible for up to $40,000 to repair or replace disaster-damaged or destroyed personal property.

- Interest rates are as low as 3.305 percent for businesses, 2.375 percent for nonprofit organizations, and 2.313 percent for homeowners and renters, with terms up to 30 years. Loan amounts and terms are set by the SBA and are based on each applicant’s financial condition.

Read the full SBA Fact Sheets here:

- Office locations: Prattville Chamber of Commerce (Autagua County), GTC Administrative Building in Selma (Dallas County)

- March 6-16 only: Williams Chapel Baptist Church – Fellowship Hall, 17595 US Highway 43, Mt. Vernon, AL 36560

- AL 17759 Fact Sheet 2023_02_07 < Updated 2/7/23

- Disaster Declaration Amendment

- FOCE_COM_AL17759_23-200_(English)_(P)_SBA_Offers_Disaster_Assistance_in_AL_for_Tornadoes_2023_03_03

- FOCE_COM_AL17759_23-201_(Spanish)_(P)_SBA_Offers_Disaster_Assistance_in_AL_for_Tornadoes_2023_03_03

What Types of Disaster Loans are Available?

- Business Physical Disaster Loans – Loans to businesses to repair or replace disaster-damaged property owned by the business, including real estate, inventories, supplies, machinery and equipment. Businesses of any size are eligible. Private, non-profit organizations such as charities, churches, private universities, etc., are also eligible.

- Economic Injury Disaster Loans (EIDL) – Working capital loans to help small businesses, small agricultural cooperatives, small businesses engaged in aquaculture, and most private, non-profit organizations of all sizes meet their ordinary and necessary financial obligations that cannot be met as a direct result of the disaster. These loans are intended to assist through the disaster recovery period.

- Home Disaster Loans – Loans to homeowners or renters to repair or replace disaster-damaged real estate and personal property, including automobiles.

What are the Credit Requirements?

- Credit History – Applicants must have a credit history acceptable to SBA.

- Repayment – Applicants must show the ability to repay all loans.

- Collateral – Collateral is required for physical loss loans over $25,000 and all EIDL loans over $25,000. SBA takes real estate as collateral when it is available. SBA will not decline a loan for lack of collateral, but requires you to pledge what is available.

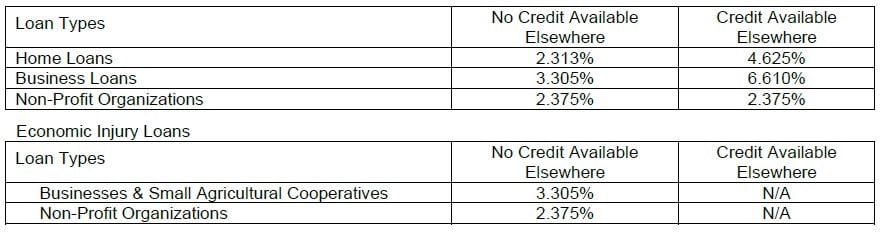

What are the Interest Rates?

- By law, the interest rates depend on whether each applicant has Credit Available Elsewhere. An applicant does not have Credit Available Elsewhere when SBA determines the applicant does not have sufficient funds or other resources, or the ability to borrow from non-government sources, to provide for its own disaster recovery. An applicant, which SBA determines to have the ability to provide for his or her own recovery is deemed to have Credit Available Elsewhere. Interest rates are fixed for the term of the loan. The interest rates applicable for this disaster are:

What are Loan Terms?

- The law authorizes loan terms up to a maximum of 30 years. However, the law restricts businesses with credit available elsewhere to a maximum 7-year term. SBA sets the installment payment amount and corresponding maturity based upon each borrower’s ability to repay.

Office Locations

Business Recovery Centers (BRC) and Disaster Recovery Centers (DCR) are open in six locations. SBA Customer Service Representatives at the Center will assist business owners and residents in filling out a disaster loan application, accept documents for existing applications, and provide updates on an application’s status. The center will operate as indicated below until further notice:

| Office Type | County | Building Name/Location | Street | City | ST | Zip | Day | Hours |

| IOF | Chilton | Alabama Emergency Management Agency | 5898 County Road 41 | Clanton | AL | 35046 | Mon – Sun | 7:00 am – 7:00 pm |

| BRC | Autauga | Prattville Area Chamber of Commerce | 131 North Court Street | Prattville | AL | 36067 | Mon – Sat | Opens Fri, Jan 27 @ 12:00 pm Mon-Fri, 8:00 am-5:00 pm Sat, 8:00 am-1:00 pm |

| BRC | Dallas | GTC Administrative Building | 2300 Summerfield Road | Selma | AL | 36701 | Mon – Sat | 8:30 am – 5:30 pm |

| DRC | Autauga | Alabama Disaster Relief Center | 118 Jesse Samuel Hunt Blvd | Prattville | AL | 36067 | Mon – Sun | Opens Thur, Jan 26 @ 1:00 pm 8:00 am – 6:00 pm |

| DRC | Coosa | Rockford Baptist Church | 9575 US-231 | Rockford | AL | 35136 | Mon – Sun | Opens Fri, Jan 27 @ 1:00 pm 8:00am – 6:00pm |

| DRC | Dallas | Crosspoint Christian Church | 1710 West Dallas Ave | Selma | AL | 36701 | Mon – Sun | Opens Thu, Jan 26 @ 1:00 pm 8:00 am – 6:00 pm |

| DRC | Elmore | Wetumpka Court House | 100 E. Commerce | Wetumpka | AL | 36092 | Mon – Sun | Opens Thu, Jan 26 @ 1:00 pm 8:00 am – 6:00 pm |

Building back smarter and stronger can be an effective recovery tool for future disasters. Applicants may be eligible for a loan amount increase of up to 20 percent of their physical damages, as verified by the SBA, for mitigation purposes. Eligible mitigation improvements may include a safe room or storm shelter, sump pump, elevation, retaining walls, and landscaping to help protect property and occupants from future damage caused by a similar disaster.

Applicants may apply online using the Electronic Loan Application (ELA) via SBA’s secure website at https://disasterloanassistance.sba.gov/ela/s/ and should apply under SBA declaration # 17759.

To be considered for all forms of disaster assistance, applicants should register online at DisasterAssistance.gov or download the FEMA mobile app. If online or mobile access is unavailable, applicants should call the FEMA toll-free helpline at 800-621-3362. Those who use 711-Relay or Video Relay Services should call 800-621-3362.

Disaster loan information and application forms can also be obtained by calling the SBA’s Customer Service Center at 800-659-2955 (if you are deaf, hard of hearing, or have a speech disability, please dial 7-1-1 to access telecommunications relay services) or sending an email to DisasterCustomerService@sba.gov. Loan applications can also be downloaded from sba.gov/disaster. Completed applications should be mailed to: U.S. Small Business Administration, Processing and Disbursement Center, 14925 Kingsport Road, Fort Worth, TX 76155.

The filing deadline to return applications for physical property damage is March 16, 2023. The deadline to return economic injury applications is Oct. 16, 2023.

Need someone to guide you through the recovery process?

Contact one of our business advisors for a no-cost Business Impact Analysis and some objective advice. We’re not here to sell insurance, and we’re not here to burden you with regulations; We just want one more small business to survive this disaster – and the next one. Our business advisors can walk you through the recovery options available from FEMA, SBA, and others (depending on the type and severity of the disaster).

Contact one of our business advisors for a no-cost Business Impact Analysis and some objective advice. We’re not here to sell insurance, and we’re not here to burden you with regulations; We just want one more small business to survive this disaster – and the next one. Our business advisors can walk you through the recovery options available from FEMA, SBA, and others (depending on the type and severity of the disaster).

Disaster Planning and Recovery Guide

Checklist for Managing in Times of Financial Difficulty

Business Emergency Plan